The Basic Principles Of Feie Calculator

Getting My Feie Calculator To Work

Table of ContentsThe Of Feie CalculatorA Biased View of Feie CalculatorThe Only Guide to Feie CalculatorThe 5-Second Trick For Feie Calculator3 Easy Facts About Feie Calculator Shown

US deportees aren't limited only to expat-specific tax breaks. Usually, they can declare much of the same tax obligation credit histories and reductions as they would in the United States, including the Youngster Tax Obligation Credit History (CTC) and the Lifetime Understanding Credit Report (LLC). It's feasible for the FEIE to reduce your AGI so a lot that you do not receive certain tax obligation credit histories, however, so you'll require to confirm your qualification.

The tax code claims that if you're an U.S. person or a resident alien of the United States and you live abroad, the internal revenue service tax obligations your globally revenue. You make it, they strain it despite where you make it. However you do obtain a wonderful exclusion for tax year 2024.

For 2024, the maximum exclusion has been increased to $126,500. There is also a quantity of qualified real estate expenditures qualified for exemption. Usually, the optimum quantity of real estate costs is limited to $37,950 for 2024. For such calculation, you require to identify your base housing quantity (line 32 of Type 2555 (https://fliphtml5.com/homepage/feiecalcu/louisbarnes09/)) which is $55.30 per day ($20,240 each year) for 2024, increased by the variety of days in your certifying duration that fall within your tax year.

The Ultimate Guide To Feie Calculator

You'll need to figure the exemption first, due to the fact that it's limited to your international earned income minus any type of foreign real estate exclusion you declare. To get the foreign made earnings exemption, the international real estate exemption or the international real estate reduction, your tax home must be in an international country, and you have to be among the following: A bona fide homeowner of a foreign country for a continuous duration that includes a whole tax obligation year (Bona Fide Homeowner Test).

for a minimum of 330 full days during any kind of period of 12 consecutive months (Physical Presence Test). The Bona Fide Homeowner Examination is not relevant to nonresident aliens. If you state to the foreign federal government that you are not a resident, the examination is not pleased. Qualification for the exclusion might additionally be influenced by some tax treaties.

For U.S. residents living abroad or earning revenue from foreign resources, questions frequently develop on just how the United state tax system applies to them and exactly how they can ensure conformity while reducing tax obligation obligation. From understanding what foreign earnings is to navigating different tax forms and reductions, it is vital for accounting professionals to understand the ins and outs of United state

The 20-Second Trick For Feie Calculator

Jump to Foreign income is revenue as any income earned revenue sources outside of the United States.

It's vital to differentiate foreign earned income from other sorts of international revenue, as the Foreign Earned Earnings Exclusion (FEIE), an important united state tax obligation benefit, specifically relates to this group. Investment revenue, rental earnings, and passive revenue from international sources do not receive the FEIE - Foreign Earned Income Exclusion. These kinds of earnings might undergo various tax treatment

resident alien who is a person or nationwide of a country with which the United States has a revenue tax treaty basically and who is a bona fide resident of a foreign country or nations for an uninterrupted period that includes an entire tax obligation year, or An U.S. citizen or a UNITED STATE

Indicators on Feie Calculator You Should Know

Foreign earned income. You must have earned income from work or self-employment in a foreign nation. Passive income, such as passion, dividends, and rental income, does not get the FEIE. Tax home. You must have a tax obligation home in an international nation. Your tax home is normally the area where you perform your regular business tasks and maintain your primary financial rate of interests.

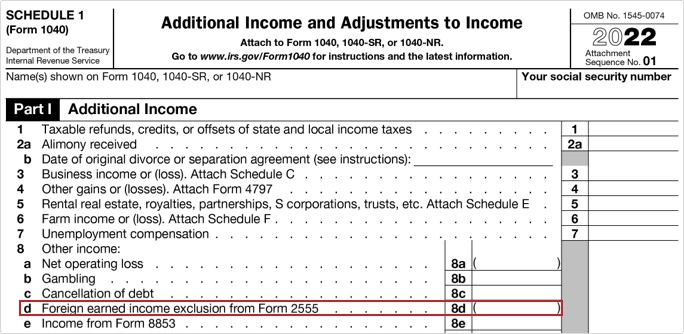

income tax return for foreign revenue taxes paid to a foreign government. This debt can counter your U.S. tax responsibility on foreign earnings that is not qualified for the FEIE, such as investment income or passive income. To declare these, you'll first need to qualify (FEIE calculator). If you do, you'll after that file added tax return (Kind 2555 for the FEIE and Kind 1116 for the FTC) and affix them to Form 1040.

3 Simple Techniques For Feie Calculator

The Foreign Earned Revenue Exemption (FEIE) permits qualified individuals to leave out a section of their foreign earned earnings from united state taxation. This exemption can dramatically lower or eliminate the U.S. tax obligation obligation on foreign revenue. Nonetheless, the details quantity of international revenue that is tax-free in the united state under the FEIE can change annually due to inflation changes.